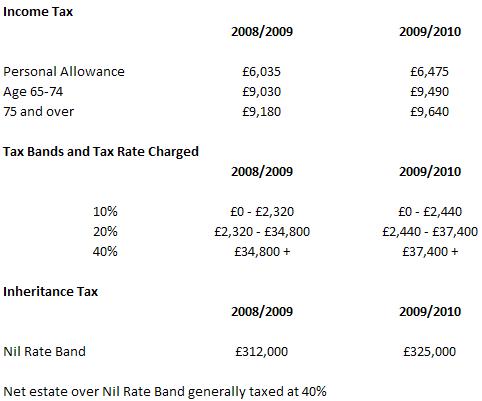

The start of the new tax year yesterday signalled changes in some of the main tax rates, reliefs and allowances and summarised below are the main rates, reliefs and allowances based on our own research: –

Capital Gains Tax

No change to personal allowance for Capital Gains Tax – remains at £9,600 for the 2009/2010 tax year

Note:

Tax allowances, rates and reliefs are subject to change. These figures are for guidance only and are correct to the best of our knowledge at the date of publication. Please check the HMRC website for current rates before making tax planning decisions.

I have a nasty feeling that in my efforts to dig myself out of debt this year, I will be kicked by the government into the 40% tax bracket for my efforts towards the end of the financial year.

Damned if you do, damned if you don’t!

Hi 🙂

Did you know that contributions to a personal pension plan effectively extend the basic rate tax bracket and you might indeed be able to receive 40% tax relief on any pension contribution.

So to invest £100 you would effectively see only £60 go out of your back pocket – a 66% return on your money in year 1.

Ok you will pay tax on your pension at the other end when you finally take benefits, which would be minimum age 55, but this gives a nice boost to an initial investment for a higher-rate taxpayer.

Of course, it is vital that you take advice which I cannot give on this site – I would strongly suggest seeing an Independent Financial Adviser before taking any action as they can advise you personally based on your own particular circumstances

Here at Shrewdcookie.com we aren’t authorised by the FSA to give financial advice. So there!