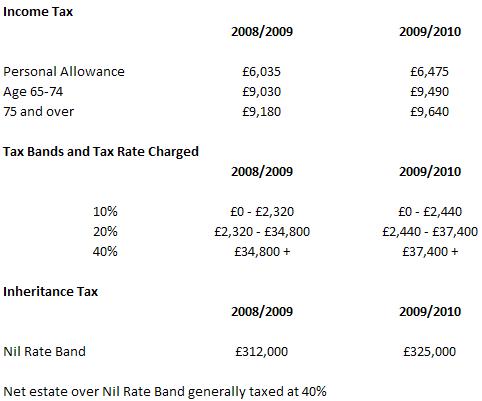

The start of the new tax year yesterday signalled changes in some of the main tax rates, reliefs and allowances and summarised below are the main rates, reliefs and allowances based on our own research: –

Capital Gains Tax

No change to personal allowance for Capital Gains Tax – remains at £9,600 for the 2009/2010 tax year

Note:

Tax allowances, rates and reliefs are subject to change. These figures are for guidance only and are correct to the best of our knowledge at the date of publication. Please check the HMRC website for current rates before making tax planning decisions.