In the first of a three part series we will consider Inheritance Tax – a tax previously deemed to be paid by “those who trust their heirs less than they trust the government”!

In part one we will consider what the tax is, how much is payable and the situation facing married couples.

What is Inheritance Tax?

Inheritance Tax is a tax payable on the value of your estate following death, and some gifts made within the 7 year period prior to your death – the tax is payable on the value of your net estate – all assets less all liabilities after certain reliefs and allowances have been made.

On what Assets is it Payable?

When considering Inheritance Tax we need to consider the domicile of the individual who has died. Domicile is a legal concept which explains a person’s true home and there are various factors affecting it. It is a complex legal subject which is beyond the scope of this article.

Generally, if you were born to UK parents, then that is your domicile and the liability to inheritance tax is payable on the value of ALL your assets, regardless of where in the world they are situated.

If you are non-UK domiciled, i.e. you moved to the UK recently, then liability to inheritance tax is calculated with reference to your UK assets only.

The tax is payable within 6 months of death and it is the duty of the Executors of your Estate to complete and file a probate form. If the tax is not paid within the 6 month window then interest will start to be charged on the amount outstanding.

How much is Payable?

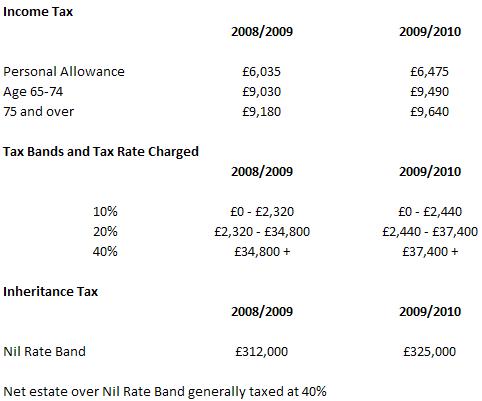

Inheritance Tax is payable at the rate of 0% on the first £325,000 in the current 2009/10 tax year, with tax at a rate of 40% payable on the value of your estate in excess of this “nil rate band”.

So for example, if your net estate is valued at say £500,000 the liability to Inheritance Tax after your death would be £70,000 (£500,000 minus £325,000 at 40% taxation).

What about for Married Couples? Didn’t the rules change for them recently?

Fortunately, the law as it stands allows for all transfers between spouses to be made with no immediate liability to inheritance tax. In these circumstances Inheritance Tax is payable on second death.

There is an exception to this rule though, and that considers the situation where a domiciled individual is married to a non-domiciled individual. If the domiciled individual dies first, the transfer to the non-domiciled widow(er) is tax-free up to £55,000. Over £55,000 inheritance tax is payable.

Since October 2007, both married couples and registered civil partners have been able to raise the threshold on their joint estates on second death by effectively transferring any unused nil rate band (personal allowance) from the estate on first death to the estate on second death.

It is important to remember that on first death, the transfer of estate from the deceased to the widow(er) is exempt from Inheritance Tax, so 100% of their personal “nil rate band” allowance can be passed along for use on second death.

Also remember, it is the percentage of unused allowance, not the value of unused allowance that is passed on to the second estate.

For example, say John dies in 2008 leaving £500,000 to his wife, but also leaving £156,000 to his son. The transfer to his wife would be free of Inheritance Tax as it is an inter-spousal transfer, and the amount left to his son would also be free of Inheritance Tax as it falls within John’s nil rate band, which is £312,000 in that tax year.

In this example, John has used 50% of his nil rate band allowance and therefore, on second death, the estate can be reduced by applying 100% of John’s widows’ nil rate band PLUS 50% passed along following John’s death. So in effect, on second death, the estate benefits from 150% of whatever the Nil Rate band is at that time!

Inheritance Tax is a complicated subject and every person’s circumstances are different – it is vitally important that you take advice from a suitable qualified solicitor or accountant before putting in place any plans to reduce your inheritance tax liability.

In the next section, we will consider the various rates and allowances which can be used to reduce the Inheritance Tax bill. The final section will outline the various methods by which the Inheritance Tax liability can be mitigated.

Just a quick heads-up people – the deadline for submitting your electronic deadline is fast approaching – 23.59 hours on Tuesday 31st January 2012.

Just a quick heads-up people – the deadline for submitting your electronic deadline is fast approaching – 23.59 hours on Tuesday 31st January 2012.