Debt-Snowball – Repaying your Debts Quicker

It is common for people to have more than one debt – for example you may have a mortgage, a personal loan, a few credit cards, hire-purchase etc. Nobody likes debt, unless it is being used as leverage for an investment, and for the majority of people the quicker it is paid off the better!

Snowball those Debts

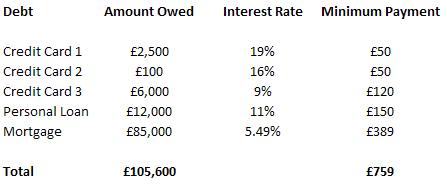

Consider a hypothetical situation whereby you have say 3 debts as shown in the following diagram –

In this example the borrower owes a total of £105,600 and is paying £759 per month for this benefit. There have been other methods mentioned on the internet whereby you effectively repay the smaller debts first. I can understand the psychology of this approach – it is easier to cope with one large debt than several smaller debts. In the example above, any surplus funds would be used to pay off Credit Card 2 first – this debt could be cleared fairly quickly based on the amount remaining outstanding and in terms of “cost” it carries an interest rate of 16% making it the second most expensive debt.

The Logical Approach to Debt Repayment

Regardless of the amount of debt outstanding let’s focus on the Interest Rate.

The interest rate tells us the “cost” of owing that amount of money. For example, with Credit Card 1 the interest rate is 19% – therefore for every £100 that we owe to that lender they will charge us £19 for those 12 months – it’s as simple as that.

To demonstrate the logic of this, consider a situation where you owe £100 to each of Credit Card 1 and Credit Card 2 in the above example – Credit Card 1 is “charging” you £19 per year for this privilege and Credit Card 2 is charging you £16 per year. If you had £100 available to repay one of those two credit cards which one would you choose? Logic dictates you repay the more expensive one first.

Conclusion

Therefore, the logical conclusion is to check all your debts and see how much they are costing you each year – check carefully as interest rates have a nasty habit of increasing beyond what you THOUGHT you were paying over time. Once you have drawn up a “league table” maximise all efforts to repay your most expensive debt first, making just minimum payments on the remaining debts – as soon as the first (most expensive) debt is paid off move on to the next one.

Action

Make a list of all debts and interest rates – make a concerted effort to repay the most expensive ones first. Maybe consider transferring any outstanding balances from higher charging credit cards to those with a nil or lower introductory balance allowing you to make greater savings and, thereby, repay your debts quicker.